Forum Discussion

BurbMan

Nov 12, 2013Explorer III

gmcsmoke wrote:

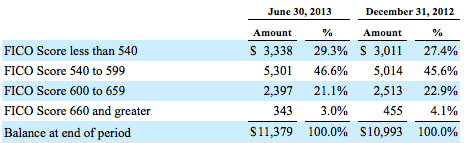

it's a said state of affairs in America when only 3% applying for an auto loan have a FICO score above 600

First off 24% of loans were granted to applicants with a score of 600 or higher. Since this chart is loans on the books and not applicants, the % of applicants with score above 600 is going to be lower, but you can't tell how much without knowing the approval rate.

This chart also tells you nothing without the associated delinquency aging and chargeoff % in each traunch.

I think in today's post-2008-bust economy that the data points that FICO uses to derive their scores are no longer good indicators of risk. 15 or 20 years ago FICO scores were good indicators, today not so much. Smart underwriters still use them as a data point but don't let them be the sole determinants of creditworthiness that they once were.

It is a stretch to conclude that GMAC is in trouble based on this data alone.

About Travel Trailer Group

44,056 PostsLatest Activity: Nov 19, 2013