Forum Discussion

26 Replies

- dodge_guyExplorer IIIf I remember right there will be no new loans to GM from the govt. the loan was a one time deal! Good luck GM.

- gmcsmokeExplorer

W4RLR wrote:

It's better to go through a bank or credit union anyway. Right now my credit union will loan money for a new car for 3% simple interest.

lol who do you think dealerships use? You think the dealership owner finances vehicles out of his own pocket? - W4RLRExplorer

gmcsmoke wrote:

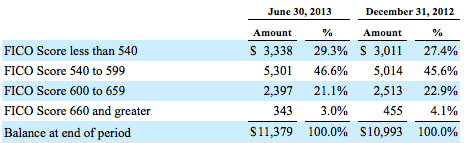

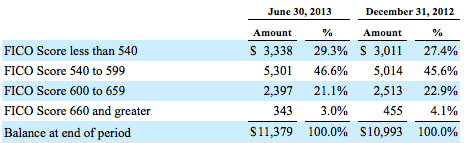

Doesn't mean much. FICO scores don't usually count when you use captive financing. Vantage scores and Beacon scores are what are used. My FICO score is over 660, but my Beacon score is far lower. Each scoring model uses different factors to predict creditworthiness.

it's a said state of affairs in America when only 3% applying for an auto loan have a FICO score above 600

It's better to go through a bank or credit union anyway. Right now my credit union will loan money for a new car for 3% simple interest. - BurbManExplorer II

gmcsmoke wrote:

it's a said state of affairs in America when only 3% applying for an auto loan have a FICO score above 600

First off 24% of loans were granted to applicants with a score of 600 or higher. Since this chart is loans on the books and not applicants, the % of applicants with score above 600 is going to be lower, but you can't tell how much without knowing the approval rate.

This chart also tells you nothing without the associated delinquency aging and chargeoff % in each traunch.

I think in today's post-2008-bust economy that the data points that FICO uses to derive their scores are no longer good indicators of risk. 15 or 20 years ago FICO scores were good indicators, today not so much. Smart underwriters still use them as a data point but don't let them be the sole determinants of creditworthiness that they once were.

It is a stretch to conclude that GMAC is in trouble based on this data alone. - 45RicochetExplorerGeese where is that nut that predicted the financial collapse of Ram while his all mighty GM was doing just fine :H

Keep you fingers crossed bow tie's. - NJRVerExplorerSince GM is the largest of course their numbers will be higher.

Follow the links in the article about GM not being alone in subprime loans and one goes to a photo of a guy in the Ford dealership.

So much for all you conspiracy types. - thomasmnileExplorerSimple. If the credit arms of the manufacturers didn't lower the bar on financing (both credit scores and lengthier finance terms)they wouldn't be able to sell anything. Cash buyers? Few and far between in the overall market I suspect........

- fla-gypsyExplorer

MARK VANDERBENT wrote:

Who cares !

I do. If my favorite auto maker was involved in unsound financial dealings that could have a huge impact on the economy I would still care. Putting on blinders will not help - midnightsadieExplorer IIGM ,is no dummy they,ll use gov money to play with and keep theres safe.

- LowRyterExplorer

goducks10 wrote:

Looks as though they have been allowing sub prime loans more than other auto makers

http://money.msn.com/investing/post--is-gm-headed-for-another-subprime-loan-crisis

"To be clear, GM, which had over $28 billion in the bank in September, isn't going bankrupt any time soon. But whether it can remain profitable is certainly an open question."

---------------------------------------

I didn't see a figure in the article regarding the percent of total GM sales involved here.

I'd still like a Corvette.

About Travel Trailer Group

44,048 PostsLatest Activity: Aug 18, 2025